When Can We Do This Again Money Ammount

We will hash out few EPF rules today. A pocket-sized part of your salary (12% of your basic salary) is invested in something called EPF or Employee Provident Fund and an equal amount is matched by your employer each month.

This is what 95% of people know, merely in that location are many things which a lot of people don't know and this article is going to open some non known secrets about EPF rules. So let's have them one by one in bespeak's format.

1: You tin can also nominate someone for your EPF

Do you know that in that location is also a "nomination" facility in EPF? The nominee will be contacted at the fourth dimension of death of the person and handed over the money from the provided fund. Yet, if the nomination is not present (which you should check), information technology can rise to all sorts of issues while claiming the money.

There is a grade chosen Grade 2 which has to be filled to change or update the nomination. Please contact your visitor finance department or directly send the form to the EPFO department.

two: One can get pension under EPF

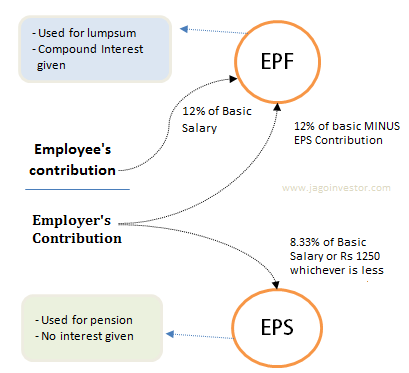

Do you know that in that location is something called EPS (Employee Pension Scheme) in the provident fund? The EPF part is really for your provided fund and EPS is for your pension.

The 12% contribution made past you from your bacon goes into your EPF fully, but the 12% contribution which your employer makes, out of that 8.33% actually goes in EPS (discipline to a maximum of Rs 1250) and the rest goes into EPF. To understand it this way, a part of your employer contribution actually makes up your pension corpus.

Just at that place are some caveats to this.

- One is liable for alimony only if one has completed the age of 58.

- One is liable for pension but if he has completed 10 yrs of service (in case of more one companies, the EPF should have been transferred, non withdrawn)

- The minimum Pension per month is Rs 1,000

- The maximum Pension per calendar month is subject area to a maximum of Rs 3,250 per month.

- Lifelong alimony is available to the member and upon his death members of the family are entitled to the alimony.

3: No interest is given on EPS (pension role)

You must be thinking that yous regularly go compound interest each twelvemonth on your contribution + employer contribution. Simply it does non work like that. The chemical compound interest is provided only on the EPF function.

The EPS part (eight.33% out of 12% contribution from your employer or Rs 1250 whatsoever is minimum) does not get whatsoever interest. At the time of PF withdrawal, you lot get both EPF and EPS.

four: You might not get 100% of your Provident Fund money

Imagine your contribution + employer contribution has been a total Rs 3,fifty,000 to date. Out of this three,l,000 , suppose 2,50,000 has gone in EPF , and residue 1,00,000 has gone in EPS (for pension) . Now if you quit your job in the 6th year of employment and opt for withdrawal of your Provided Fund money (EPF + EPS actually), so do yous retrieve you will get a total of 3,50,000. NO!

That's because you always get 100% of your EPF function, but for EPS there is a carve up rule.

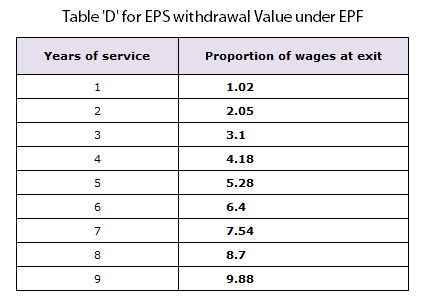

There is something called Tabular array 'D', nether which its mentioned how much you get at the fourth dimension of leave from your chore, there is a slab for each completed year and you get n times of your last fatigued salary (depending on the completed year of service) subject to maximum to Rs 15,000 per month.

So if your salary, in this case, was Rs 30,000 per month, even so you will be given but 15,000 * vi.forty = Rs 96,000.

Notation that the table D is upwards to 9 yrs merely, because if 10 yrs are crossed, then yous are liable for a alimony.

5: Yous tin invest more than in Provident Fund, its called VPF

You lot tin e'er invest more than 12% of your basic bacon in Employee Provident Fund which is called VPF (Voluntary Provident Fund). In this case, the excess amount volition exist invested in PF and you lot will keep on getting the interest, simply the employer is not supposed to match your contribution. He will just invest up to a maximum of 12% of your bones, not more than than that.

6: Withdrawing of EPF amount at job modify is illegal

Nearly everyone thinks that withdrawing of your Employee Provident Fund amount afterwards a job switch is totally fine and allowed, however equally per the EPF Rules, it's illegal.

You can simply withdraw your Employee provident fund money, only if you have no task at the time of withdrawing your money and if 2 months take passed. The merely transfer is allowed in case you go a new chore and you lot switch to it.

While in that location are no cases where EPF office tracks these things and takes up this matter, notwithstanding simply for your information you lot should know that if you got a new job and took it and so you are applying for withdrawal, it'south illegal as per law.

What in the case of EPS?

In the case of EPS, if the service period is less than 10 years, you have the choice to either withdraw your corpus or become information technology transferred by obtaining a 'Scheme Certificate'. One time, the service period crosses ten years, the withdrawal option ceases.

Just for your information, you lot tin withdraw your EPF money without the help of by employer signature past attesting your withdrawal form by a depository financial institution manager or some gazetted officer. I hope yous are articulate near EPF withdrawal rules.

7: One can opt-out of EPF if he wants

Yes!. I know this might be a surprising fact for many, just if one's basic salary per month is more than Rs 15,000, he has an selection to opt-out of PF and not exist office of it. In which example he volition get all his salary in paw (without annihilation deducted every calendar month).

But the deplorable part is that ane has to opt-out of Provident Fund at the commencement of his chore. If a person has been office of EPF even once in his life, then he tin can't opt-out of information technology. So if yous have already had EPF in your life.

This option is not for yous, but if y'all are new to the job and your PF business relationship number all the same does non exist, you can tell your employer that you don't want to be part of Employee provident fund. You will have to fill up form 11 for this.

viii: Your EPF gives you some life insurance too

A lot of people might not know that in case a company is not providing grouping life insurance encompass to its employees, in that example, the employee is given a modest life cover through EPF. This is considering at that place is something called Employees' Deposit Linked Insurance (EDLI) scheme and your organization has to contribute 0.five% of your monthly basic pay, capped at Rs 15,000, as premium for your life comprehend.

Yet, companies that already have life insurance benefits to employees every bit part of the company, are exempted from this EDLI scheme. The bad part of this EDLI scheme is that the life cover nether this option is very low and that's the maximum amount of Rs. lx,000. While this is peanuts for most of the people in big cities.

For employees in small scale industries and small cities, this amount of Rs 60,000 volition still count something.

ix: You can employ EPF coin can be withdrawn at special occasions

So now you know that EPF withdrawal is not permitted if yous are even so working. But there are occasions when Employee provident fund withdrawal is allowed.

While you cannot withdraw information technology fully, yous tin withdraw a partial corporeality. Post-obit is a listing of events when y'all tin withdraw the Provident Fund amount and the conditions yous need to fulfill

1. Marriage or didactics of self, children or siblings

– Y'all should have completed a minimum of seven years of service.

– The maximum amount you can describe is l% of your contribution

– You can avail of it three times in your working life.

– Y'all will have to submit the nuptials invite or a certified copy of the fee payable.

2. Medical treatment for Cocky or family (spouse, children, dependent parents)

– For major surgical operations or for TB, leprosy, paralysis, cancer, mental or middle ailments

– The maximum amount you can draw is six times your bacon

– Y'all must show proof of hospitalization for ane calendar month or more with exit document for that menstruation from your employer.

iii. Repay a housing loan for a house in the proper name of self, spouse or owned jointly

– You should have completed at least x years of service.

– You are eligible to withdraw an corporeality that is up to 36 times your wages.

4. Alterations/repairs to an existing home for a house in the name of self, spouse or jointly

– You need a minimum service of five years (10 years for repairs) after the house was built/bought.

– You tin draw upward to 12 times the wages, but once.

5. Construction or purchase of a house or flat/site or plot for self or spouse or joint ownership

– Y'all should take completed at to the lowest degree five years of service.

– The maximum corporeality you can avail of is 36 times your wages. To purchase a site or plot, the amount is 24 times your salary.

– Information technology tin can exist avail of it only once during the unabridged service.

10: You lot tin file an RTI application for EPF issues

Did you know that you can file an RTI applicative to get any kind of information regarding your EPF? Y'all can file information technology if you are facing issues like no clarity nigh EPF balance, no action taken for your EPF withdrawal or transfer. To find out information about other issues on the Provident Fund. I take done a detailed post on how to file an RTI for your EPF upshot.

Lookout this video to know how to file RTI for EPF withdrawal or transfer issues:

UPDATES

- In the recent budget 2015, the govt has made information technology clear that now an employee tin can cull between EPF and NPS. The employer will have to give this option.

- Now the new system of UAN is in place for EPF, which has made a lot of things more simpler

Conclusion on EPF rules

The overall Employee provident fund rules are too complicated and very old. A common man does non know all these EPF rules, but knowing these minimum 10 EPF rules will help him in his financial life.

Source: https://www.jagoinvestor.com/2012/05/epf-facts-employee-providend-fund.html

0 Response to "When Can We Do This Again Money Ammount"

Post a Comment